Sign In

Welcome! Sign In to personalize your Cat.com experience

If you already have an existing account with another Cat App, you can use the same account to sign in here

Register Now

One Account. All of Cat.

Your Caterpillar account is the single account you use to log in to select services and applications we offer. Shop for parts and machines online, manage your fleet, go mobile, and more.

Account Information

Site Settings

Security

Act Now to Leverage

CHP Tax Credits Up to 50%

By Tom Smith, Senior Director of Energy Development, Caterpillar Electric Power interviews Devin Hall, Crowe LLP

The Inflation Reduction Act (IRA), signed into law in August 2022, provides nearly $400 billion in tax credits and incentives over a decade to promote climate change mitigation and stimulate clean energy development in the U.S. It’s the largest single investment in climate and energy in American history — and it includes the highest incentives ever provided by the federal government for combined heat and power (CHP) projects.

What’s included? What’s required? And how can you take advantage of these incentives to make your cogeneration projects more economically viable? I sat down with an expert to get some answers. Here’s what Devin Hall, managing partner for energy at Crowe LLP, had to tell me about CHP and the IRA:

Tom: First off, can you explain what CHP incentives are included in the new law?

Devin: There’s an existing federal investment tax credit that provides incentives for installing CHP systems. The IRA increases that tax credit to 30%, and it can jump even higher if:

- The project is located in an “energy community.” There’s a 10% bonus for installing CHP systems in locations that have been (or still are) heavily dependent on fossil fuels as a driver of local economic activity, employment and government revenue.

- The project meets “domestic content” requirements. There’s another 10% bonus for installing U.S.-made CHP solutions that applies to projects commissioned starting in 2023 and going forward. It’s designed to reward American manufacturers.

Tom: Are there any extra tax credits for zero-carbon emissions projects?

Devin: The IRA establishes a clean electricity tax credit for zero-carbon energy solutions. That begins January 1, 2025, and runs through 2032. CHP systems fueled by renewables, including biogas and green hydrogen, should be eligible for this credit. Also, any CHP projects that begin construction after December 31, 2024, and yield zero greenhouse gas emissions should qualify for renewable energy tax credits.

Tom: Are utility interconnection costs eligible for incentives?

Devin: For projects less than 5 MW, you can receive a credit on the costs for utility interconnection property including charges related to utility-owned equipment. The credit percentage may vary depending on specific facts and circumstances.

Tom: There must be some eligibility requirements — what are they?

Devin: IRA tax credits are available for CHP systems fueled by natural gas, biomass and other fuels. Overall efficiency must exceed 60% when measuring useful power created by the system divided by total energy from the fuel, including heat recovery, to qualify. If your project is greater than 1 MW, you must also pay prevailing wages and maintain an apprenticeship program during construction and any repairs or alterations made in the first five years of operation. The credit phases out gradually for projects greater than 15MW and is phased out completely at 50MW.

We expect the IRS to publish rules better defining these criteria and the evaluation process. Right now, we do know that if you can’t demonstrate compliance with the prevailing wage and apprenticeship requirement, you’ll only be eligible for a base rate tax credit of 6%.

Tom: I’ve heard even some tax-exempt customers are eligible for these credits. Is that true?

Devin: Yes, non-tax-paying entities qualify for a “direct pay” option, which allows them to receive a check directly from the IRS for most of the energy credits in the IRA. This allows tax-exempt entities to benefit from a tax credit without having a tax liability. This could dramatically reduce the cost of operating high-efficiency, low-carbon CHP systems for facilities owned and operated by nonprofit organizations or state and local government entities. These organizations also have the option to sell the tax credit to a third party.

Tom: What’s the timeline to qualify for these incentives?

Devin: The deadline to receive CHP tax credits under the Inflation Reduction Act is December 30, 2024. Construction must begin before January 1, 2025. There are two ways to show construction began before January 1, 2025. The first is completing physical work of a significant nature, including both on-site and off-site work. The second is the incursion or payment of 5% of the total cost of the energy property. Under each of these methods there is also a continuity requirement which requires there to be continual progress toward the completion of the project. It’s important to note that projects must be completed by the end of 2028.

The time to act is now.

The content and answers featured in this blog are for information purposes only, please consult with a tax expert for full details and guidance on IRA opportunities.

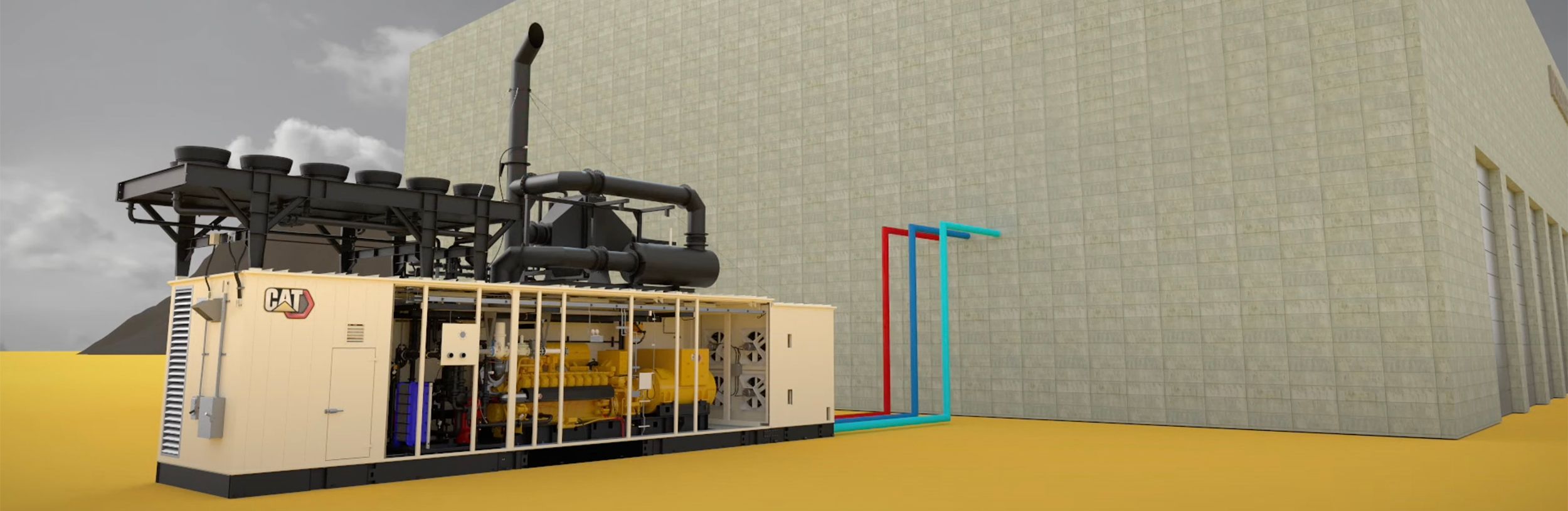

December 30, 2024, will be here before we know it. If you’re considering starting a CHP project, now’s the time to move forward. The CHP Alliance has put together an FAQs document that dives into even more details, and our team at Caterpillar is here to help as well. We offer a full range of CHP products and services you can employ to achieve your energy objectives and qualify for these expanded tax credits. Reach out to our experts to learn more.

Tom Smith

Tom Smith is senior director of energy development for Caterpillar Power Solutions. He helps direct our energy development efforts and is responsible for growing and supporting our energy as a service and microgrid businesses. He also supports the sales and service of our generation products, including distributed power, economic dispatch/resiliency and CHP systems. Tom is active in power generation industry associations, including the United States Combined Heat and Power Alliance (president), Cogeneration World Coalition (president), Northeast Clean Heat and Power Initiative (board member) and Midwest Cogeneration Association (board member).

Devin Hall

Devin Hall leads Crowe LLP’s global energy practice, which offers audit, tax and consulting services for energy clients. He also serves as a leader in Crowe’s National Tax Office, providing federal tax consulting solutions. Devin is a technical expert in energy credits and research and development tax credits, and he has extensive experience with the IRS and state authorities in the tax credit area.

Related Stories

-

How Municipal Utilities Can Address Surging Power Demand

For many municipal utility managers I talk to, it’s getting tougher to continue providing the highest levels of reliability, service, and value. Customer preferences are changing. Some want 100% renewable power overnight; others simply care about cost. Other challenges are mounting, too: New technologies. Increased regulation. Workforce shortages. Budget constraints. And perhaps biggest of all, rising demand.

Learn More -

5 Steps to Sign-Off on a New Energy Solution

You’re a large energy consumer, maybe in healthcare, education, distribution or transportation. You’re facing pressure — internal, external or both — to increase your energy resiliency, lower your carbon emissions, reduce your energy costs, add capacity for expansion, or some combination of all four. You know you need to act (and soon), but you’re struggling with how to get started implementing a solution.

Learn More -

Is Your Organization a Good Fit for EaaS? And Is Your EaaS Partner a Good Fit for You?

Our EaaS team at Caterpillar has implemented solutions for all types of operations: from K-12 schools and grocery stores to industrial facilities. The concept — you purchase energy outcomes and turn ownership and upkeep of energy assets over to a third party — works for many organizations. How do you know if yours is one of them?

Learn More -

Demystifying the EaaS Model: Don’t Buy Power Products. Buy Energy Outcomes.

Software as a Service, or SaaS. Today, most applications — everything from Microsoft Office to Google Drive to Salesforce — are hosted by a third-party provider and made available via the web or a mobile app. You don’t need to install or configure anything on your computer, and the SaaS provider handles all maintenance, upgrades, and licensing. It’s more convenient for users and more affordable for businesses.

Learn More -

Hydrogen’s True Colors: A Key to Defining Carbon Intensity

Often referred to as a “clean-burning” fuel, hydrogen is the most abundant chemical substance in the universe because its combustion generates near-zero greenhouse gas emissions at the tailpipe. . It’s also colorless, odorless and burns with a near-invisible flame. So why does nearly every Google search or news story about hydrogen turn up terms like “green,” “blue” and even “pink”?

Learn More -

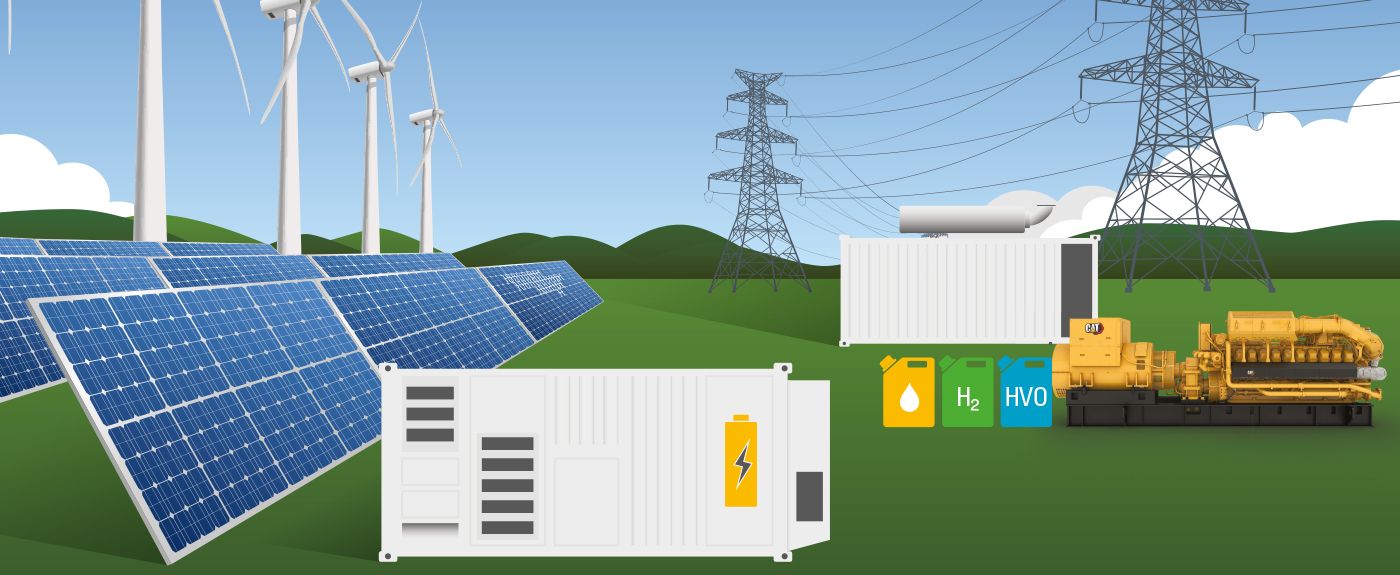

Distributed Energy Benefits and Grid Systems Integration

Our electric power system faces many challenges, and as the energy landscape evolves to address increased electrification, we will have even greater demand than ever before. Caterpillar is positioned to serve as a trusted partner with the technologies and expertise to provide alternatives to established energy sources and fuels that are reliable and cost effective.

Learn More -

Trends in the Energy Transition

When it comes to the ongoing efforts to decarbonize and reduce greenhouse gas (GHG) emissions, renewables are making up more and more of our sources of power generation, and we think this will continue—for many positive reasons. We have a lot of customers who are setting targets for Environmental, Social, and Governance (ESG) goals, aiming for improved carbon reduction.

Learn More