Sign In

Welcome! Sign In to personalize your Cat.com experience

If you already have an existing account with another Cat App, you can use the same account to sign in here

Register Now

One Account. All of Cat.

Your Caterpillar account is the single account you use to log in to select services and applications we offer. Shop for parts and machines online, manage your fleet, go mobile, and more.

Account Information

Site Settings

Security

Rebuild Financing. New Machine Financing. Cat® Card Financing. Find Out Why Sellers Construction Does It All With Cat Financial

It started as one company with three machines. Now it’s three unique businesses with a fleet of 450. Sellers Construction has come a long way since 1999. President Rader Sellers gives much of the credit to a 20-year relationship with Cat Financial.

Watch the Testimonial

Read Their Story

Solutions Overview

Related Content

Case Study

CUSTOMER:

Sellers Construction

INDUSTRY:

Mining, Grading, Transport

SOLUTION:

Rebuild Financing

LOCATION:

Georgia, US

DEALER:

Customer Story

Previously, Sellers Construction was just another mining contractor in central Georgia. Today, it’s one of the state’s leading companies across multiple industries. Instrumental in that growth: a longtime relationship with Cat Financial.

In 1999, Rader Sellers bought two small Cat® articulated trucks and a D6 dozer from Cat dealer Yancey Bros. Then he got to work supporting the mining industry as a small, overburdened contractor. Today, he oversees three companies: Sellers Construction (mining and earthmoving), Sellers Contracting (grading and site development) and Sellers Transport Services (heavy haul). His fleet now includes approximately 450 pieces of equipment.

Most are yellow. More than 100 have been financed by Cat Financial. “They’ve been instrumental in helping build our fleet,” Sellers says. “They’ve been very competitive with their rates.”

Competitive rates aren’t the only reason for choosing Cat Financial services, though. For Sellers, the most important factor is industry knowledge.

Sellers appreciates that Cat Financial services are tailored to his equipment and business needs.

“They understand the product, plain and simple,” Sellers says. “They understand how long things should last. They understand how long we should be financing stuff. We’re on the same page, and that makes it easy.”

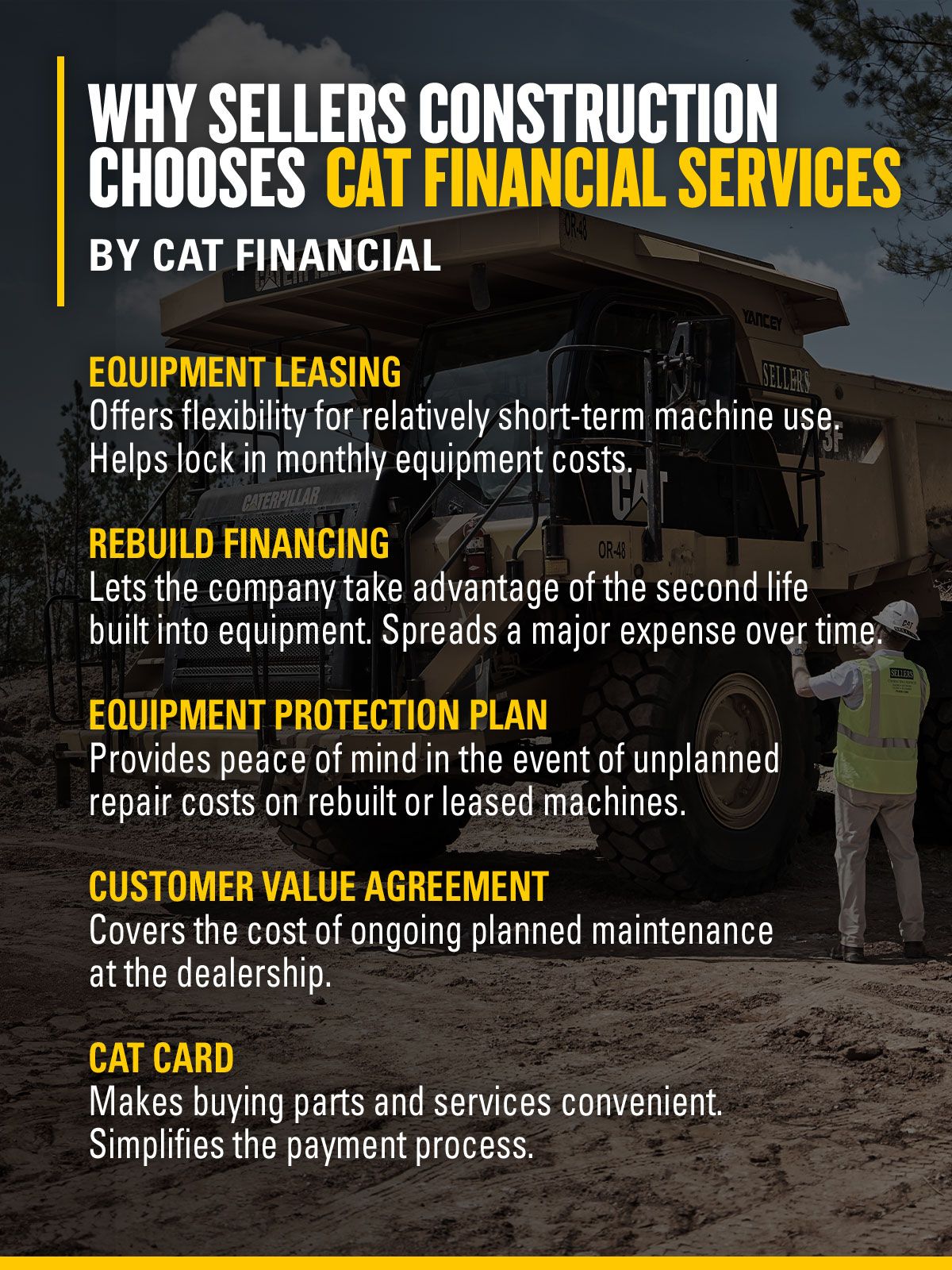

To acquire large excavators used on mining and earthmoving jobs, Sellers Construction uses the Cat equipment lease. These machines often operate five or six days a week. Sometimes they run up to 10 hours a day.

“It’s very demanding work,” Sellers says. “Over three or four years, we start to lose efficiency. We want to trade in and start over. The Cat equipment lease allows us that flexibility.”

It also simplifies budgeting.

“The value that leasing brings is we know our monthly costs,” says Trippe Brooks, vice president at Sellers Construction. “We factor everything in, from maintenance to repairs. We can nail it down to a per-yard number.”

Another budget-saver for Sellers Construction is rebuilding equipment.

In 2017, the company completed its first Cat Certified Rebuild. Rebuilds return end-of-life machines, systems and components to like-new condition. The cost is typically just 55-60% of buying new.

“Rebuilding the machine to get a second life plays a big part in keeping our costs down,” Brooks says. “We can pass that on to our customers.”

Sellers Construction has rebuilt a dozen trucks with Yancey Bros. The company plans to put 10 dozers through the program. Cat Financial services include rebuild financing, which spreads the cost over time.

“For me, it’s a no-brainer,” Sellers says.

Rebuilt machines include a like-new warranty on all replaced parts. Sellers Construction also adds an Equipment Protection Plan (EPP) through Cat Financial.

EPP steps in when the warranty expires. It provides protection from unplanned repair costs caused by covered defects in Cat material and manufacturer workmanship.

That peace of mind has convinced Sellers Construction to buy EPP for many leased machines, too.

“We want to know we’re not going to add unexpected cost,” Brooks says. “We purchase EPP up front for the life of the lease. We have a fixed cost per cycle for that machine.”

For added security, Sellers Construction purchases many machines with a Customer Value Agreement (CVA). A Cat CVA is a hassle-free ownership and maintenance plan. It includes genuine Cat parts, equipment health management tools and flexible dealer support.

That’s important because Sellers Construction counts on Yancey Bros. for ongoing planned maintenance (PM) and repairs.

“Trying to find service people is almost as hard, if not harder, than trying to find experienced operators,” Brooks says. “The agreement takes some pressure off us as we grow. We rely on the dealership a lot more for PM.”

Expenses like rebuilds, EPP and a Cat CVA can all go on the Cat Card, a Cat Financial commercial account. Cat customers can use this flexible, unsecured line of credit to pay for parts, engines, attachments, repairs, rentals and more.

Sellers Construction uses the Cat Card for most parts and service purchases made at Yancey Bros. It helps the company manage cash flow and simplifies payment.

Sellers and Brooks both appreciate that Cat Financial services are available through Yancey Bros. It makes for one-stop shopping: Acquiring, financing, protecting and maintaining equipment is quick and easy.

“What I love about working with Cat Financial and Yancey is that we understand each other,” Sellers says. “We know each other inside and out. The areas that don’t work well, we improve. The areas that do work well, we build on.”

Related Content

-

The Buyer's Guide for Financing Cat® Equipment

Use these resources to simplify online shopping, Cat equipment financing and much more.

GET THE GUIDE -

Engine Protection: Why Add Extended Service Coverage?

Find out how to add engine or generator protection to help control costs and downtime.

GET THE DETAILS -

4 Ways Cat Financial Services Offer You More Value

Discover the advantages of Cat Financial services versus those of traditional lenders.

SEE THE DIFFERENCE -

Faivre-Rampant Carrières Finances Their Cat® Machine Rebuild

Cat® Financial provides the best financial solution for a family-owned business by financing their machine rebuild.

Read Their Story